From the Kampala News:

....MUCH MORE

They seem pretty chill.

In war, everything not censored is a lie.

Fewer notes too but they're not alliterative.

From the ZH eXtwitter feed:

Treasury cash soars by $173BN on April 15 to $897BN, as taxes come in; this is the highest in two years and gives TSY $150BN in stimmy dry powder (less Bill issuance, less RRP drain). pic.twitter.com/tqa7vFE90w

— zerohedge (@zerohedge) April 16, 2024

Well, the West had a good run. I suppose we can all become models and influencers now.

From The Australian Financial Review, April 25:

The Biden administration and European governments are increasingly alarmed at the potential for China’s EV ambitions to put their own car manufacturers at risk.

China wants to replicate its spectacularly successful strategy in flooding global markets with cheaper manufactured goods that drive most Western competitors out of business.

A key battleground is the supply of electric vehicles – using an ever more advanced version of technology exports to leverage global efforts on emissions reduction.

The contradictions between the experience and expectations of Chinese EV car makers compared with those in Europe and the US are obvious in the International Energy Agency’s latest report on EVs.

The report predicts more than one in five cars sold this year will be electric, 17 million globally. In the first three months of 2024, numbers are up by 25 per cent – around the same percentage increase as a year ago, but from a larger base.

An optimistic IEA executive director Fatih Birol maintains continued momentum is clear in the data. “Rather than tapering off, the global EV revolution appears to be gearing up for a new phase of growth,” he says. “The wave of investment in battery manufacturing suggests the EV supply chain is advancing to meet automakers’ ambitious plans for expansion.”

That momentum will also pick up due to steadily falling prices. Climate Change and Energy Minister Chris Bowen will no doubt be delighted by the impact on Australian consumers’ low take-up of EVs.

But how does this fit with evidence of slowing customer enthusiasm for EV purchases in most Western countries? Yes, numbers are growing – just not as quickly as anticipated in the broader consumer market now early adopters have been accommodated and mass market buyers are more concerned about range and charging facilities as well as cost.

Birol concedes the momentum is stronger in some markets than others.

The reluctance is most obvious in the US – despite the Biden administration’s subsidies – but is also showing up in weakening sales growth in Europe. The results have already led to many traditional automakers cutting back or delaying their investment plans to shift away from internal combustion engine vehicles.

The catch for them is that Chinese exporters, led by BYD, are driving much of what growth there is in EV sales by savagely undercutting them on prices....

....MUCH MORE

Also at the AFR: "Retirement made me feel invisible – so I became a male model"

Here's the IEA:

Global EV Outlook 2024

Moving towards increased affordability

It is possible that Mr. Musk knows more about electric vehicles and the retail market for electric vehicles than I do. And it is possible that he intuits something about the industry or the regulatory or government policy framework toward electric vehicles that he hopes to either guard against or take advantage of.

And it's possible he's just a self-made centibillionaire loony....

It's also a demand problem. Residential rooftop installer SunPower just announced they were laying off one-quarter of their workforce due to declining demand. From PV Magazine, April 24:

SunPower to close business units, cut about 26% of workforce

And the headline story from the Washington Post, April 24/25:

In a federal complaint, American companies accuse Asian firms of illegally flooding the United States with Chinese-subsidized solar panels

Several of the largest American solar manufacturing companies are demanding aggressive action against cheap imports, arguing in a petition filed Wednesday with the Commerce Department that firms in four Asian countries are illegally flooding the U.S. market with Chinese-subsidized panels....

....MORE

Related, April 3:

"China has flooded the market with so many solar panels that people are using them as garden fencing"

For folks keeping score, China now dominates batteries, the solar supply

chain from polysilicon ingots to solar panels, electric vehicles and

wind generation.

The rumors are once again circulating that the President is planning to issue some sort of Executive Order regarding climate and we happened to have this piece in the link-vault.

Blow a bit of dust off and its good as new. From Bloomberg, July 19, 2022:

Democrats and environmental activists are pushing President Joe Biden to declare a “climate emergency” and unlock sweeping powers to combat global warming after broad legislation stalled in Congress.

Biden has already vowed to “take strong executive action” if Congress doesn’t “tackle the climate crisis.” And White House officials are now weighing

the possibility of an emergency declaration that would empower the president to curtail oil drilling, curb fossil-fuel flows and fund clean-energy construction.

1. How would it work?

An emergency declaration by Biden would trigger powers laid out by a suite of federal laws — including energy statutes, the National Emergencies Act and the Stafford Disaster Relief and Emergency Assistance Act — that the president could wield to address the climate crisis.Biden could curtail or block crude exports thanks to a national security exemption in a 2015 law that would allow him to re-impose licensing requirements and other restrictions on those flows. At the same time, the Aviation and Transportation Security Act — enacted after the Sept. 11, 2001 terror attacks — could empower him to coordinate domestic transportation in ways that limit the movement of fossil fuels.

Under the Outer Continental Shelf Lands Act that governs energy development in US coastal waters, he could also suspend offshore drilling, even on existing leases. That provision was invoked to suspend some activity in the wake of the Deepwater Horizon disaster in 2010.

2. What about clean energy?

A climate emergency would let Biden take advantage of a law typically used after major hurricanes and other natural disasters -- the Stafford Disaster Relief and Emergency Assistance Act -- to direct the Federal Emergency Management Agency to construct renewable energy projects using federal money. FEMA has $19 billion budgeted for fiscal year 2022 to address ongoing disasters, according to the Center for Biological Diversity, an environmental group urging the move.Biden could also use the Cold War-era Defense Production Act and the federal procurement budget of $650 billion per year to manufacture clean transportation technologies and generate renewable energy, according to a report by the center. Biden has already used the same law to boost production of baby formula amid a national shortage. But the law specifically contemplates power production; the statute uniquely singles out renewable energy and storage as critical materials for national defense.

3. What can’t he do?

Some of the most powerful tools for propelling renewable power projects and advanced energy manufacturing were tax credits — now stymied in Congress — that can’t be easily duplicated through executive order. Any federal funding directed at the sector is finite, and can be quickly ended once a new president is in office....

....MUCH MORE

If one is interested, we saved the proposed Executive Orders prepared by the University of Colorado for President Obama in 2008. It runs to 213 pages and serves as the outro from August 2023's "Ahead Of A Possible Climate Emergency Declaration, Some Interesting Phenomena".

Huawei is taking their profits from the phone business and doing a lot of investing in their futuretech. I just wish they had done the lasers on sharks thing.

From AsiaFinancial, April 24:

The Chinese tech firm has also launched seven EV models in partnership with domestic automakers as it bids to become a major player in the sector

Chinese tech giant Huawei has unveiled a new intelligent driving software brand which it’s aiming to see installed in 500,000 vehicles before the end of the year.

The new brand, Qiankun, symbolising a combination of heaven and the Kunlun Mountains, plans to provide self-driving systems involving the driving chassis, audio and driver’s seat, Jin Yuzhi, CEO of Huawei’s Intelligent Automotive Solution (IAS) business unit, said during an event on Wednesday ahead of the Beijing auto show.

“2024 will be the first year for mass commercialisation of smart driving and the cumulative number of cars on road equipped with the Huawei self-driving system will top 500,000 by the year-end,” Jin said.

He also expected within a year more than 10 car models adopting Huawei’s Qiankun system would hit the market.

The Shenzhen-based tech conglomerate launched its smart car unit in 2019 with the aim that it could become the equivalent of German automotive supplier Bosch of the intelligent EV era and supply software and components to partners....

....MUCH MORE

There's also this yesterday, Reuters via Yahoo Finance:

A group of Chinese chip companies led by Huawei Technologies and backed by the country's government aims to produce high-bandwidth memory (HBM) semiconductors, a key component in AI chips by 2026, The Information reported on Thursday....

Recently:

Chips: "Huawei building vast chip equipment R&D center in Shanghai"

At the moment I don't think ASML has to worry but U.S. policymakers should be dusting off their contingency plans. They have contingency plans, right? I think they're in the same drawer as the CDC's pandemic response folder....

And the sharks?

....And us? Among other things we were linking to stuff like: "'More BP Gulf Oil Spill Conspiracies Flourish -- From Algae Farms to Armed Dolphins' (APC; BP; HAL; RIG)"

Which reminds me, I should probably follow up on the Chinese Security Law posts which for some reason included this tidbit:

‘At Huawei, we’re not attaching laser beams to the heads of sharks’—Alykhan Velshi, Vice President, Corporate Affairs, Huawei Technologies Canada, Markham, Ont.Letter to the Editor, Maclean's Magazine, published July 23, 2019Personally I think laser-enhanced sharks would be kind of cool, it's the required handing over of data should the Chinese government request it that gives one pause.

Recapitulated in "Forget sharks with lasers, NASA kits out an elephant seal with a sensor-studded skullcap"

That’s exactly what he’s been doing for the last five years.

The company he built, Redwood Materials, is now the largest battery recycler in North America, and it’s using those recycled materials to manufacture complex battery components that have traditionally been imported from abroad, largely from China.

Straubel recently opened the doors for a first peek at the 300-acre industrial campus he’s built in the western Nevada desert. He said it hasn’t been easy.

“It feels like we’re going at breakneck speed, but we need to do a whole lot more,” he said. “It’s a damn hard thing to do.”

Straubel, 48, drives a Tesla Cybertruck emblazoned with his company’s green infinity logo, but he's careful to note that the flashy ride is a personal vehicle — “too expensive for Redwood.” Often seen as a countervailing force to Musk while they were building Tesla, Straubel returned last year to take a seat on the electric vehicle maker’s board. He wouldn’t talk about his oversight job there, other than his general motivation for doing it.

“I want it to succeed. I love the team there, it's close to my heart — always probably will be,” he said.

Straubel spoke to Bloomberg Green on March 22, the day Redwood commissioned its first commercial-scale line to produce cathode active material, a black powder that’s largely responsible for a battery’s range and longevity — and cost. He reflected on what it’s taken to build Redwood to this point, and his plans for what comes next. What follows is an edited transcript of the conversation.

Some EV manufacturers are tapping the breaks on expansion plans right now. What’s your reading of the EV market and how it looks five years from now?

Personally I think the EV transition is kind of a slow, steady, and inevitable future course that we are going to go through — and have to go through. When we started Redwood, I was really looking at the 10, 20, 30-year horizon and how we were going to affect sustainability and transportation. I don't see any change in my long-term thinking on this.

What will a mature recycling industry look like in the US? Will it be distributed like it is in China, or a few big players that dominate?

I don’t have a one-size-fits-all, monopolistic view on this. It’s really how we can best architect a solution for the country to get as much material recovered and recycled, as quickly as possible. There may be more smaller companies at different parts of the value chain. That would be great if they can compete, and we’re happy to work with a lot of small companies.

But there weren’t really any other companies that I saw doing what was needed, so that’s kind of why we jumped in with the scope we did. There was a little bit of a gold rush that went on, when people saw what we were doing and thought it would be easy. I wish them well, but this is a long road. It’s something we need to be building for many years, maybe decades.

How necessary are government subsidies for making the numbers work on recycling?

Today, we don’t have a single dollar from the federal government. Everything we’ve built to date has been funded by either our investors or from money that we’ve made recycling and selling. We’ve had to bootstrap and move things along as we go....

....MUCH MORE

Hurry up, come public would ya!

[we are fans: https://climateerinvest.blogspot.com/search?q=redwood+materials]

We've looked at the definition and etymology of speculation a few times, more after the jump.

In the meantime, here, coming in at a different angle of attack, the blog of The Journal of the History of Ideas:

In the winter of 1891, a young John Dewey published an article in a student newspaper at the University of Michigan, where he had just begun to teach. The article, a response to what Dewey felt was a regrettable trend toward obscurantism in philosophers’ writings about truth, was titled “The Scholastic and the Speculator.” Dewey proposed a division between two ways of knowing what is true. The first way was to find a real quality of the world—a fact, or equally a moral principle—and pluck it from its context to lend it an air of universality. This was the “Scholastic’s” method. It involved “taking a thing out of relations and keeping it out” (151). “Not to put too fine a point on it,” Dewey continued, but “the Scholastic was an embezzler.” He “sav[ed] and stor[ed]” without ever giving back. Yet “this abstraction, this saving cannot be all there is to the matter,” Dewey insisted. “These must have some end, some use. What is it?” (152).

The answer came with the second way of getting at truth. “Intelligence must throw its fund out again into the stress of life,” wrote Dewey. “It must venture its savings against the pressure of facts” (152). This was the method of the Speculator, whose procedures Dewey elaborated with an extended economic metaphor:

Every judgment a man passes on life is perforce, his ‘I bet,’ his speculation. So much of his saved capital of truth he invests in the judgment: ‘The state of things is thus and so.’ The current of fact sweeps in this judgment and returns it to him with interest. His guess, his venture has won: the logicians call it verification. Or the stream of fact carries away his investment and he never sees it again. His speculation was against the set of the market and he has lost. (154)

Dewey’s economy of truth was financial. Truths were never fixed. They were contingent social creations that gained (or lost) their value over time and through their reception in the ever-changing “stream of fact.” This fluctuation of value and the uncertainty it generated were inevitable—and, what is more intriguing, they were necessary for the generation and discovery of future truths. The speculator did not know if his beliefs would make it out there in the world. Without that risk, the entire process of speculation would make no sense. Uncertainty was a happy precondition of those investments, those wagers, which brought new truths into being.

And yet if Dewey’s metaphor nodded to the productive capacities of finance, it also struck a note of caution. Healthy speculation had its limits. “There is a speculation which exists just for the sake of the speculation,” Dewey cautioned (154). The key was to remain an investor who stakes his individual funds for a social end. This, Dewey concluded, was the proper kind of truth-seeker: one who “both saves and spends, yet neither embezzles nor gambles” (154). To a striking degree, Dewey’s vision presages the model form of investment that John Maynard Keynes would lay out many decades later in his General Theory. For capitalism to work, Keynes argued, capitalists must not speculate wildly and must not hoard their money under the bed—two forms of equally destructive liquidity fetish. Instead, they must use their liquidity toward long-term, productive investments. As with capital for Keynes, so with truth for Dewey....

....MUCH MORE

From February 2, 2009—remember February 2009, it was in all the papers, Great Recession about to end, but not quite yet, 50%+ decline in the S&P 500 with one last out-the-door whack on the longs about to commence. Good times:

Where in the Bear are We?

Our two guiding principles right now, are:

Anything past settlement date is long term.

Anything long term is terminal....*****....One etymology of the word speculation:

c.1374, "contemplation, consideration," from O.Fr. speculation, from L.L. speculationem (nom. speculatio) "contemplation, observation," from L. speculatus, pp. of speculari "observe," from specere "to look at, view" (see scope (1)). Disparaging sense of "mere conjecture" is recorded from 1575. Meaning "buying and selling in search of profit from rise and fall of market value" is recorded from 1774; short form spec is attested from 1794. Speculator in the financial sense is first recorded 1778. Speculate is a 1599 back-formation.That is not the etymology grandmother taught me. Hers had to do with Italian merchants keeping watchtowers manned to spot sails over the horizon, enabling those who could see furthest to sell off inventory before goods-ladened ships made harbor and crashed the market. More like this etymology at Wictionary:From Latin speculātus, past participle of speculor (“‘look out’”), from specula (“‘watchtower’”), from specio (“‘look at’”)Either way, the current market does not lend itself to either contemplation or seeing over the horizon....

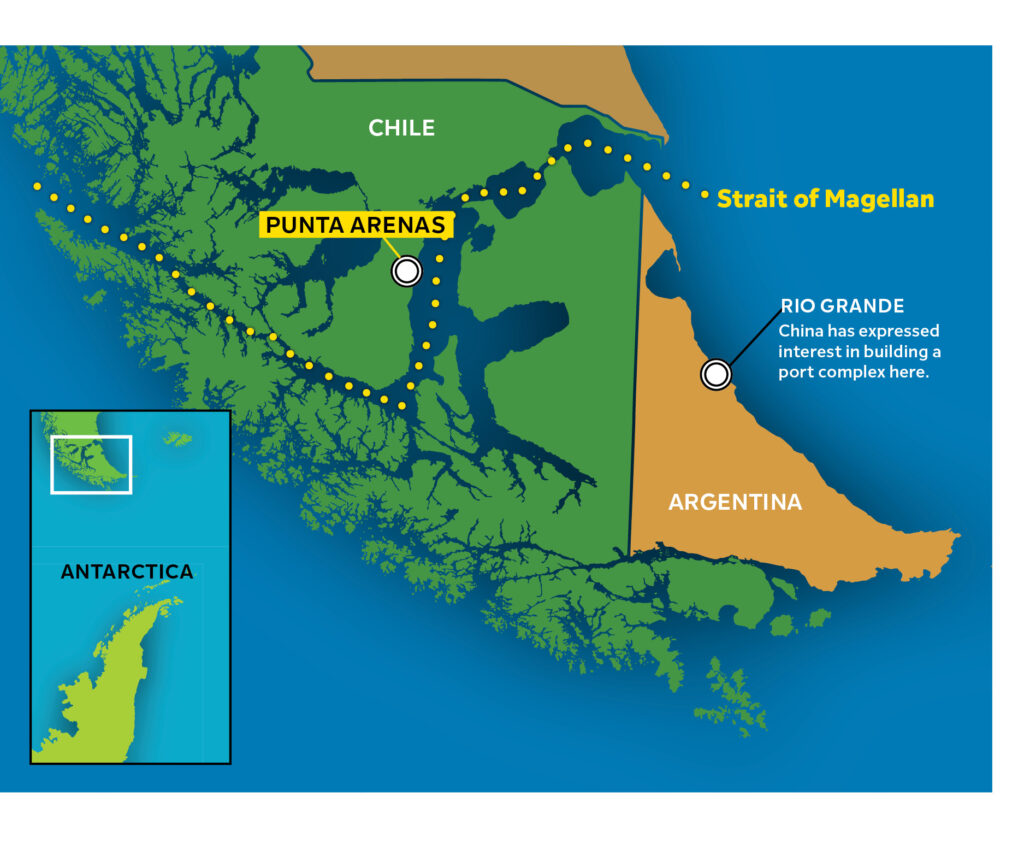

From Americas Quarterly, April 23:

Punta Arenas sits at the very tip of South America…Punta Arenas is at the intersection of changing shipping routes, new industries like green hydrogen, and the race for Antarctica. The U.S. and China have noticed.

This article is adapted from AQ’s special report on Latin America’s ports | Leer en español | Ler em português

PUNTA ARENAS, CHILE — Perched on the pylons of a century-old coal pier, sleek black cormorants gaze out at cruise ships, propane tankers and research vessels dotting the white-capped Strait of Magellan. Farther into the horizon, a humpback whale blows a misty plume toward the sky.

This is a postcard from the end of the world, postmarked Punta Arenas.

But it’s not as remote as you might think.

Punta Arenas has become an unlikely hotspot for global shipping, one of several seaports gaining importance today across Latin America and the Caribbean. As wars choke vital shipping lanes in the Middle East and Europe, climate change snarls the Panama Canal and technological breakthroughs such as green hydrogen come to the fore, even ports on the region’s periphery are getting new attention from governments, multinational companies and others.

The changing tide is reflected in the soaring volume of merchant ships crossing the Strait of Magellan. In January and February, traffic jumped by 25% from the same period in 2023, and by 83% compared with 2021, when supply chains were still disrupted by the pandemic. Chile’s navy is bracing for this year’s traffic to increase by as much as an additional 70%.

“We’re in a part of the world that’s increasingly strategic, and it transcends the country,” Punta Arenas Mayor Claudio Radonich told AQ.

Global powers are racing to expand their presence. China has expressed interest in building a port complex near the Strait’s Atlantic mouth just across Chile’s border in Argentina. From there, Beijing could grow its presence in the region and also project influence in Antarctica, where geopolitical rivalry is heating up as the sea ice melts. In April 2023, the head of the U.S. military’s Southern Command, General Laura Richardson, visited Argentina and Chile, stopping in Punta Arenas for a security briefing and a tour of the strait.

To properly seize the moment, Punta Arenas and the surrounding Magallanes region desperately need an infrastructure upgrade. At present, the region only has a few jetties and ramps, capable of receiving midsize vessels, some cruise ships and barges—but not large tankers and container vessels of the kind increasingly sailing through the strait. There are no loading cranes or protected basins. Even the navy lacks a port of its own here.

“If we want to move toward more just and inclusive development, we need more and better ports,” Chile’s President Gabriel Boric declared last October at the signing of a port expansion plan in Valparaíso. He lauded the “extraordinary modernization” of ports he had visited in China the previous week. Boric, who grew up in Punta Arenas, signed a $400 million, five-year investment program in November to upgrade ports and other infrastructure in Magallanes. But some wonder if it will be enough....

....MUCH MORE

This is the part of Bidenomics (borrowing big to spend bigger) that might be justifiable. At the conclusion of the construction you have, at minimum, a building to show for the loot. Whether they are worth the money spent or if they could have been built without the handouts is for the policy peeps to argue over.

From ConstructionDive, updated April 18:

New additions to the tracker this month include a $3.9 billion SK Hynix chip plant in West Lafayette, Indiana, and a $1.2 billion Fujifilm project in Holly Springs, North Carolina.

Spending in the manufacturing sector has ballooned since the CHIPS Act was signed into law in August 2022. Projects underway include everything from plants focused on chip fabrication and electric vehicle batteries to consumer goods and cars.

Here, Construction Dive rounds up the biggest of these projects announced since August 2022, sorted by value and location, along with their contractors when available. Please check this page for regular updates.The U.S. continues to gain ground on other countries’ manufacturing dominance a year after President Joe Biden signed the $52 billion CHIPS and Science Act in August 2022.

The renewed push to revive American manufacturing after decades of offshoring has led to over $688 billion in private company investment, according to the White House. The multibillion-dollar investments scattered across the country range from biotechnology facilities and chip fabrication plants to electric vehicle battery factories and clean energy projects.

Some major manufacturing projects added to this page over the past four weeks include a $3.9 billion SK Hynix chip plant in West Lafayette, Indiana, a $1.2 billion Fujifilm project in Holly Springs, North Carolina, and a $300 million XNRGY manufacturing facility in Mesa, Arizona.

The map also lists the contractors working on these projects when they are available. Some of the notable wins since the last update include:

- Wespac Construction’s contract on a $300 million manufacturing facility in Mesa, Arizona, for XNRGY, a Monteal-based company that makes climate systems for data centers.

- Whiting-Turner’s award on a $300 million AstraZeneca cell therapy manufacturing facility in Rockville, Maryland....

....MUCH MORE, including the handy map

Earlier today:

Jamie Dimon, "Now He's Worried About An Artificial Economy 'Fueled by Government Deficit Spending'"

Possibly related, yesterday at Reuters:

Biden notches another union endorsement as building trades back reelection

Also at ConstructionDive, April 25:

First up, from Yahoo Finance, April 25:

GDP: US economy grows at 1.6% annual pace in first quarter, falling short of estimates

The US economy grew at a slower pace than expected in the first quarter.

The Bureau of Economic Analysis's advance estimate of first quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 1.6% during the period. Economists surveyed by Bloomberg estimated the US economy grew at an annualized pace of 2.5% during the period.

The reading came in significantly lower than fourth quarter GDP, which was revised up to 3.9%....

....MUCH MORE

And from the AP via U.S. News & World Report, April 25:

US Applications for Jobless Claims Fall to Lowest Level in 9 Weeks

Fewer Americans applied for unemployment benefits last week as the labor market continues to hold up despite higher interest rates imposed by the Federal Reserve in its bid to curb inflation

....MUCH MORE

Bonds are getting hit, with the CBOE interest rate futures on the 10-year pricing 4.7210% (+0.0690). Major stock indices down 1.4% to 1.8%.

Thanks, I think, to a friend.

From Big Think, July 28, 2021:

Research shows that those who spend more time speaking tend to emerge as the leaders of groups, regardless of their intelligence.

A new study proposes the "babble hypothesis" of becoming a group leader. Researchers show that intelligence is not the most important factor in leadership. Those who talk the most tend to emerge as group leaders.

If you want to become a leader, start yammering. It doesn’t even necessarily matter what you say. New research shows that groups without a leader can find one if somebody starts talking a lot.

This phenomenon, described by the “babble hypothesis” of leadership, depends neither on group member intelligence nor personality. Leaders emerge based on the quantity of speaking, not quality.

Researcher Neil G. MacLaren, lead author of the study published in The Leadership Quarterly, believes his team’s work may improve how groups are organized and how individuals within them are trained and evaluated....

....MUCH MORE

Huh. So if someone asks if I'm familiar with "The Babel hypothesis," I'll have to remember to ask "one 'b' or two?" "two 'b's' or three" [forgot a 'b']

An opportunity to hammer-home what is probably the most important fact about the current iteration of the American economy.

Lifted in toto from Benzinga, April 18:

In the chaos of the 2008 recession, perhaps no bank stood more prepared than Jamie Dimon's J.P Morgan Chase & Co.

In advance of the crisis, Jamie Dimon realized that "underwriting standards were deteriorating across the industry," with late payments on subprime loans rising.

In late 2006, the bank led his firm to exit Wall Street's hot subprime business, starting with a frantic call made to J.P. Morgan's vacationing Chief of Securitized Products where he said, "I really want you to watch out for subprime! We need to sell a lot of our positions. I’ve seen it before. This stuff could go up in smoke!”

By getting out of the soon-to-be toxic products, J.P. Morgan was able to go on the offensive when other banks pulled back too late or were forced into bankruptcy.

J.P. Morgan's stock has risen nearly 260% from its pre-global-financial-crisis peak.

Reflecting on the recession, Dimon said "counter to what most people think, many of the extreme actions we took were not done to make a profit; they were done to support our country and the financial system."

Dimon is sounding the alarm on a debt-fueled economy appearing healthier than reality may be.

In his most recent annual shareholder letter, Dimon said, "The U.S. economy continues to be resilient, with consumers still spending. and the markets currently expect a soft landing." However, he offered this caveat, saying that "it is important to note that the economy is being fueled by large amounts of government deficit spending and past stimulus."

With the U.S. national debt already surpassing $34.6 trillion at a time when the Federal Reserve is still unable to cut interest rates in the face of stubborn inflation, interest payments on the debt are set to exceed U.S. defense spending this year.

Whether the increasing fiscal debt becomes a problem impacting broader markets to the extent that the subprime crisis did remains to be seen, but Dimon and his firm are prepared for anything with J.P. Morgan's self-described "fortress balance sheet."

Benzinga home page.

We visited Dimon and his letter to the JPM shareholders in "JP Morgan Chairman's Letter on Inflation, April 8, 2024 (JPM)" and "Inflation—JPMorgan CEO Jamie Dimon's Comments On The Bank's First Quarter Results (JPM)" and we looked at one possible end game exiting from March 20's ""Hotshot Wharton professor sees $34 trillion debt triggering 2025 meltdown as mortgage rates spike above 7%: ‘It could derail the next administration’"":

This is the sort of stuff I was thinking about in the intro to March 6's "Michelle Obama's office says the former first lady 'will not be running for president' in 2024":

...On the other hand, I'm not sure you would want to be President during the next four years, there are so many problems that have been growing and metastasizing just beneath the surface of the daily news that the person in the hot seat could end up just plain reviled.If I were a Democrat strategist I would propose letting Donald Trump win a second term while concentrating on House and especially Senate (to bottle up judicial, including Supreme Court, nominees) races.

A Trump win would give an excuse for riots (for the visuals) and if he is handcuffed by the Legislative branch to limit the range of possible responses, you go beyond polycrisis to the omnicrisis. Throw in a bit of Frances Fox Piven with her "overwhelm the system" and "motor voter" strategies and you could see one-party rule for thirty years....

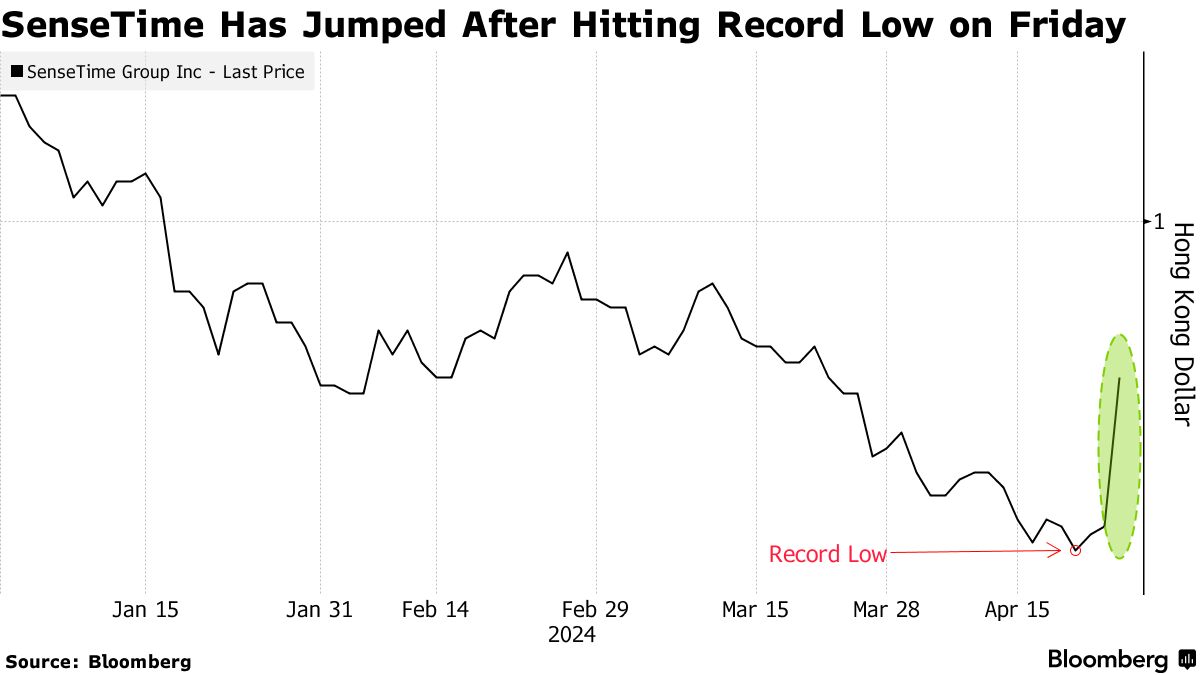

Ha! We just flashed-back on SenseTime in Monday's post on the British real-time facial recognition vans and apps: ICYMI: The Most Valuable AI Start-up In the World Does Facial Recognition.

From Bloomberg, April 23/24:

China’s SenseTime Surges 36% After Unveiling a New AI Model

- US-blacklisted firm unveils fifth version of its AI platform

- The company is one of many racing to develop generative AI

SenseTime Group Inc.’s stock soared its most in more than two years after releasing the latest version of its SenseNova generative AI model, highlighting the intense interest surrounding China’s efforts to develop artificial intelligence.

The shares gained as much as 36% after the company revealed SenseNova 5.0 during its Tech Day event in Shanghai. The ChatGPT-like platform has “significantly” improved in terms of linguistic and creative capabilities, Chairman Xu Li said in a statement. Trading in the stock was suspended after the abrupt surge but will resume Thursday.

SenseTime is among a growing number of Chinese corporations and startups exploring ways to develop an answer to OpenAI’s ChatGPT. In 2023, it joined Baidu Inc. and Alibaba Group Holding Ltd. in developing its own inhouse generative AI platform. The potentially transformative technology has since become a key area in which Beijing is encouraging local companies to compete with their US counterparts.

The company said in a filing it was unaware of any reasons for the dramatic share price surge apart from SenseNova 5.0, which comes with about 600 billion parameters. “It achieved significant improvements in knowledge, mathematics, reasoning and coding capabilities, and its performance is generally comparable to GPT-4 Turbo,” the company said in the filing.

....MUCH MORE

The story at BiometricUpdate is headlined:Its a tough business.

From the South China Morning Post, April 24:

- Overall industry profitability could become negative in 2024, if BYD introduces 10,300 yuan (US$1,421) price cut, US bank says

- Overall profit for EVs across the board has declined from 2,100 yuan to negative 1,600 yuan since July last year: Goldman report

Further discounts offered by carmakers in a price war in mainland China’s electric vehicle (EV) market could ensnare even the likes of top seller BYD, Goldman Sachs said.Its net profit could become zero if BYD offers another price reduction of 10,300 yuan (US$1,421) per vehicle, a fresh sign that an escalating price war in the world’s largest EV market will become detrimental to the fast-growing industry, the US bank said in a report released on Tuesday.

“If another 10,300 yuan price cut comes about (in line with our assumption for BYD), we estimate overall industry profitability could turn negative in 2024,” Goldman said. The discount would represent 7 per cent of the company’s average selling price for its vehicles, Goldman added. BYD mainly builds budget models priced from 100,000 yuan to 200,000 yuan.

Since July last year, the overall profit for EVs across the board has declined from 2,100 yuan to negative 1,600 yuan, driven by a 21,000 yuan price drop, or 11 per cent of the cars’ average selling price, the report said.

Weak interest in EVs due to concerns about a battered economy and incomes during the first quarter of this year have resulted in a wave of price cuts at key carmakers on the mainland....

That would certainly shake things up.

From Bloomberg via yahoo Dinance, April 24:

The swaps market is flashing warnings there could be a dash for dollar liquidity on a scale last seen at the start of the pandemic, according to Mizuho International Plc.

Andra Belcea, head of cross-currency swaps trading at Mizuho, flags the cross-currency basis — a measure of the extra cost non-US banks face when sourcing dollars offshore instead of through their US-based branch.

Derived from the cost of exchanging cash flows in one currency for those in another, it shows the cost of dollars is now near the lows seen after central banks took emergency steps to pump liquidity into markets in the wake of the pandemic.

“Risky asset classes are doing great,” said Belcea. “But the market is wondering when the music will stop.”

There were tremors earlier in the month, when the situation in the Middle East threatened to escalate, triggering a jump in demand for dollars. A year ago, the collapse of Silicon Valley Bank in the US spurred a much bigger rush.

And if US rates remain lofty, US banks may allocate more dollars onshore, buying Treasury bills or parking them at the Fed’s reverse repo facility instead of lending them overseas....

....MORE

A bit behind the curve there S&P.

From the San Francisco Chronicle, April 22:

San Francisco’s post-pandemic downturn threatens city’s historically strong credit rating

Weakness in San Francisco’s commercial real estate market and the slow-moving recovery of economic drivers such as tourism stand to jeopardize the city’s ability to repay its debt, according to S&P Global Ratings.

The financial services firm this week downgraded its outlook on the city’s outstanding general obligation and appropriation debt from “stable” to “negative.” The move comes as office vacancy in San Francisco hit a record 36.6% in the first quarter of the year, exacerbating the city’s fiscal challenges in the wake of the pandemic.

San Francisco is projected to face a $245 million budget deficit in the coming fiscal year and a $555 million deficit in the following year. The shortfall could balloon to more than $1 billion by 2027 if expenditures continue to outpace revenue growth.

S&P said in a release that it believes that San Francisco’s “management will be challenged to make the cuts needed to restore it to budgetary balance during the outlook horizon, which could lead to rating pressure if the city’s general fund reserves decline precipitously.”....

....MORE

Also at the Chronicle:

Empty S.F. office tower formerly valued at $62 million sold for $6.5 million

From Reuters, April 12:

Shareholders cannot sue companies for fraud if they flout a rule requiring disclosure of trends expected to affect their bottom line unless the omission makes another statement misleading, the U.S. Supreme Court ruled on Friday.

The 9-0 ruling authored by liberal Justice Sonia Sotomayor handed a victory to Macquarie Infrastructure in a proposed shareholder class action accusing the company of failing to disclose that its revenues were vulnerable to an international phase-out of high-sulfur fuel oil between 2016 and 2018.The justices reversed a decision by the New York-based 2nd U.S. Circuit Court of Appeals to allow the class action brought by Hedge fund Moab Partners to proceed. A federal judge earlier had dismissed the litigation.Sotomayor wrote that while the anti-fraud provision of a federal law called the Securities Act of 1933 clearly prohibits companies from telling misleading half truths, it does not automatically apply when a company remains silent....

From Semafor, April 17:

The Scoop

The private equity firm Carlyle Group is courting artificial intelligence-focused data centers as anchor customers for a series of large solar power farms it’s building in the Arizona desert.

Two years after Carlyle founded its own renewable-energy development company, Copia Power, construction is underway on its first project: a $2 billion, 1.5-gigawatt solar-and-storage project outside of Phoenix. A second, similar project is expected to break ground nearby later this year, and a third 1.5-gigawatt facility is in development for the near future. Although the customers Copia Power initially locked in are fairly routine — the local utility and the hardware chain Lowe’s — the company is now shifting its focus to target tech companies, which have emerged as the U.S. power market’s most voracious buyers of low-carbon electricity, Pooja Goyal, Carlyle’s chief investment officer for infrastructure and head of renewables, told Semafor.

“We knew there was going to be a lot of demand from corporate customers for the energy from these projects,” she said. “But we definitely did not take into account the demand pull from AI that is happening right now. That’s become a major accelerator to the original investment thesis.”....

....MUCH MORE

From the New York Post, April 22:

Investors in Sam Bankman-Fried’s bankrupt crypto firm FTX agreed to drop their claims against the convicted fraudster in exchange for his cooperation in lawsuits against other defendants — including celebrities Tom Brady, Gisele Bundchen and Larry David who promoted the company before its stunning collapse.

According to the settlement — filed by a group of FTX investors in Miami federal court Friday — Bankman–Fried would be free of any civil liabilities from the multi-district litigation now and in the future, according to Bloomberg.

As part of the proposed settlement, which still needs approval from a judge, Bankman-Fried has agreed to hand over all nonprivileged documents detailing his assets and his investment in Google and Amazon-backed artificial intelligence startup Anthropic, an affidavit certifying his net worth as negative and documents about other defendants in the lawsuits, Bloomberg reported.

Bankman-Fried is also set to provide the group of FTX investors with any information he can about the accountants, lawyers and venture capital firms that worked with his disgraced exchange, which collapsed in November 2022 after Bankman-Fried swiped user funds to plug an $8 billion debt at sister company Alameda Research.

NFL legend Brady, his ex-wife Gisele Bundchen and “Curb Your Enthusiasm” star David, along with Steph Curry, Shaquille O’Neill and Naomi Osaka had appeared in ads promoting FTX and are fighting lawsuits brought by shareholders....

....MUCH MORE

Prop bet: If President Biden loses his bid for re-election, Bankman-Fried and Pa Bankman and Ma Fried are on the Presidential pardon list. Any takers?

As we saw in April 14's RAND: "Artificial Intelligence and Biotechnology: Risks and Opportunities" the RAND Corporation has very deep connections to AI, going back almost seventy years.

From Wired, April 23:

A National Security Insider Does the Math on the Dangers of AI

Jason Matheny, CEO of the influential think tank Rand Corporation, says advances in AI are making it easier to learn how to build biological weapons and other tools of destruction.

Jason Matheny is a delight to speak with, provided you’re up for a lengthy conversation about potential technological and biomedical catastrophe.

Now CEO and president of Rand Corporation, Matheny has built a career out of thinking about such gloomy scenarios. An economist by training with a focus on public health, he dived into the worlds of pharmaceutical development and cultivated meat before turning his attention to national security.

As director of Intelligence Advanced Research Projects Activity, the US intelligence community's research agency, he pushed for more attention to the dangers of biological weapons and badly designed artificial intelligence. In 2021, Matheny was tapped to be President Biden’s senior adviser on technology and national security issues. And then, in July of last year, he became CEO and president of Rand, the oldest nonprofit think tank in the US, which has shaped government policy on nuclear strategy, the Vietnam War, and the development of the internet.

Matheny talks about threats like AI-enabled bioterrorism in convincing but measured tones, Mr. Doomsday in a casual suit. He’s steering Rand to investigate the daunting risks to US democracy, map out new strategies around climate and energy, and explore paths to “competition without catastrophe” in China. But his long-time concerns about biological weapons and AI remain top of mind.

Onstage with WIRED at the recent Verify cybersecurity conference in Sausalito, California, hosted by the Aspen Institute and Hewlett Foundation, he warned that AI is making it easier to learn how to build biological weapons and other potentially devastating tools. (There’s a reason why he joked that he would pick up the tab at the bar afterward.) The conversation has been edited for length and clarity.

Lauren Goode: To start, we should talk about your role at Rand and what you’re envisioning for the future there. Rand has played a critical role in a lot of US history. It has helped inform, you know, the creation of the internet—

Jason Matheny: We’re still working out the bugs. [*]

Right. We’re going to fix it all tonight. Rand has also influenced nuclear strategy, the Vietnam War, the space race. What do you hope that your tenure at Rand will be defined by?

There’s three areas that I really want to help grow. First, we need a framework for thinking about what [technological] competition looks like without a race to the bottom on safety and security. For example, how can we assure competition with China without catastrophe? A second area of focus is thinking about how we can map out a climate and energy strategy for the country, in a way that is acceptable to our technology requirements, the infrastructure that we have and are building, and gets the economics right.

And then a third area is understanding the risks to democracy right now, not just in the United States but globally. We're seeing an erosion of norms in how facts and evidence are treated in policy debates. We have a set of very anxious researchers at Rand who are seeing this decay of norms. I think that's something that's happening not just in the United States but globally, alongside a resurgence of variants of autocracy.

One type of risk you’ve been very interested in for a long time is “biorisk.” What’s the worst thing that could possibly happen? Take us through that.

I started out in public health before I worked in national security, working on infectious disease control—malaria and tuberculosis. In 2002, the first virus was synthesized from scratch on a Darpa project, and it was sort of an “oh crap” moment for the biosciences and the public health community, realizing biology is going to become an engineering discipline that could be potentially misused. I was working with veterans of the smallpox eradication campaign, and they thought, “Crap, we just spent decades eradicating a disease that now could be synthesized from scratch.”....

....MUCH MORE

Still a few bugs in the system. Ha Ha.

In pre-market action the stock is up $17.47 (+12.07%) at $162.15.

Below are the words that are adding billions ($50+) to the company's valuation.

Personally I think Musk is going to pull it off, but that's just me—perhaps informed by posting on the company and its stock since before the June 2010 share flotation (which, adjusted for the 5:1 and 3:1 stock splits gives a $1.133 IPO price)—however, there are plenty of other opinions to choose from if one doesn't care for that one.

With that, here are the thoughts of the cultural observer Sting in his seminal work "De Do Do Do, De Da Da Da" as the conclusion of this intro:

And the words. From MarketBeat, April 23, 2024:

Provided by AlphaStreet

Tesla Q1 2024 Earnings Call Transcript

[Operator Instructions] But before we jump into Q&A, Elon has some opening remarks. Elon?

Elon MuskChief Executive Officer at TeslaThanks, Martin. To recap, in Q1, we navigated several unforeseen challenges as well as the ramp of the updated Model 3 in Fremont. As we all have seen, the EV adoption rate globally is under pressure and a lot of other auto manufacturers are pulling back on EVs and pursuing plug-in hybrids instead. We believe this is not the right strategy and electric vehicles will ultimately dominate the market. Despite these challenges, the Tesla team did a great job executing in a tough environment and energy storage deployments of Megapack, in particular, reached an all-time high in Q1 leading to record profitability for the energy business. And that looks likely to continue to increase in the quarters and years ahead. It will increase.

We actually know it will, so significantly faster than the car business as we expected. We also continue to expand our AI training capacity in Q1 more than doubling our training compute sequentially. In terms of the new product road map, there's been a lot of talk about our upcoming vehicle line in the next -- in the past several weeks. We've updated our future of vehicle lineup to accelerate the launch of new models ahead, previously mentioned start of production in the second half of 2025. So we expect it to be more like the early 2025, if not late this year.

These new vehicles, including more affordable models will use aspects of the next-generation platform as well as aspects of our current platforms, and we'll be able to produce on the same manufacturing lines as our current vehicle lineup. So it's not contingent upon any new factory or massive new production line, it will be made on our current production lines much more efficiently. And we think this should allow us to get to over 3 million vehicles of capacity when realized to the full extent.

Regarding FSD Version 12, which is the pure AI-based self-driving, if you haven't experienced this, I strongly urge you to try it out, it's profound. And the rate of improvement is rapid. And we've now turned that on for all cars with the cameras and inference computer everything from Hardware 3 in North America. So it's been pushed out to, I think, around 1.8 million vehicles, and we're seeing about half of people use it so far and that percentage is increasing with each passing week. So we now have over 300 billion miles that have been driven with FSD V12. And since the launch of full self-driving -- supervised full self-driving, it's become very clear that the vision-based approach with end-to-end neural networks is the right solution for scalable autonomy. And it's really how humans drive. Our entire road network is designed for biological neural nets and eyes. So naturally, cameras and digital neural nets are the solution to our current road system.

To make it more accessible, we've reduced the subscription price to $99 a month, so it's easy to try out. And as we've announced, we will be showcasing our purpose built Robotaxi or Cybercab in August. Yeah. Regarding AI compute. Over the past few months, we've been actively working on expanding Tesla's core AI infrastructure. For a while there, we were training constrained in our progress. We are, at this point, no longer training constraint, and so we're making rapid progress. We've installed and commissioned, meaning they're actually working 35,000 H100 computers or GPUs. GPU is wrong word, they need a new word. I always feel like a winds [Phonetic] when I say GPU because it's not. GPU stands -- G stands for graphics. Roughly 35,000 H100S are active, and we expect that to be probably 85,000 or thereabouts by the end of this year and training, just for training. We are making sure that we're being as efficient as possible in our training. It's not just about the number of H100s, but how efficiently they're used.

So in conclusion, we're super excited about our autonomy road map. I think it should be obvious to anyone who's driving Version 12 and it is only a matter of time before we exceed the reliability of humans in not much time with that. And we're really headed for an electric vehicle and autonomous future. And I go back to something I said several years ago that in the future, gasoline cars that are not autonomous will be like riding a horse and using a flip board [Phonetic]. And that will become very obvious in hindsight. We continue to make the necessary investments that will drive growth and profits will test in the future, and I wanted to thank the Tesla team for incredible execution during this period and look forward to everything that we have planned ahead. Next.

Martin ViechaVice President of Investor Relations at TeslaThank you very much, and Vaibhav has some comments as well.

Vaibhav TanejaChief Financial Officer at TeslaThanks. It's important to acknowledge what Elon said, from our auto business perspective, we did see a decline in revenues quarter-over-quarter and these were primarily because of seasonality, uncertain macroeconomic environment and other reasons, which Elon had mentioned earlier. Auto margins declined from 18.9% to 18.5%, excluding the impact of Cybertruck.

The impact of pricing actions was largely offset by reductions in per unit costs and the recognition of revenue from Autopilot feature for certain vehicles in the U.S. that previously did not have that functionality. Additionally, while we did experience higher cost due to the ramp of Model 3 in Fremont and disruptions in Berlin, these costs were largely offset by cost reduction initiatives.

In fact, if we exclude Cybertruck and Fremont Model 3 ramp costs, the revenue from auto margins improved slightly. Currently normalized Model Y cost per vehicle in Austin and Berlin are already very close to that of Fremont. Our ability to reduce costs without sacrificing on quality was due to the amazing efforts of the team, in executing Tesla's relentless pursuit of efficiency across the business. We've also witnessed that as other OEMs are pulling back on their investments in EV, there is increasing appetite for credits, and that means a steady stream of revenue for us. Obviously, seeing others pull back from EVs not the future we want. We would prefer it, the whole industry went all in.

On the demand front, we've undertaken a variety of initiatives, including lowering the price of both the purchase and subscription options for launching extremely attractive leasing specials for the Model 3 in the U.S. for $299 a month and offering attractive financing options in certain markets. We believe that our awareness activities paired with attractive financing will go a long way in expanding our reach and driving demand for our products. Our Energy business continues to make meaningful progress with margins reaching a record of 24.6%. We expect the energy storage deployments for 2024 to grow at least 75% higher from 2023.

And accordingly, this business will begin contributing significantly to our overall profitability. Note that there is a bit of lumpiness in our storage deployments due to a variety of factors that are outside of our control, so deployments may fluctuate quarter-over-quarter.

On the operating expense front, we saw a sequential increase from our AI initiatives, continued investment in future projects, marketing and other activities. We had negative free cash flow of $2.5 billion in the first quarter. The primary driver of this was an increase in inventory from a mismatch between builds and deliveries as discussed before, and our elevated spend on capex across various initiatives, including AI compute. We expect the inventory build to reverse in the second quarter and free cash flow to return to positive again.

As we prepare the company for the next phase of growth, we had to make the hard but necessary decision to reduce our head count by over 10%. The savings generated are expected to be well in excess of $1 billion on an annual run rate basis. We are also getting hyper focused on capex efficiency and utilizing our installed capacity in a more efficient manner. The savings from these initiatives, including our cost reductions will help improve our overall profitability and ultimately enable us to increase the scale of our investments in AI.

In conclusion, the future is extremely bright and the journey to get there while challenging will be extremely rewarding. Once again, I would like to thank the whole Tesla team for delivering great results. And we can open it up to Q&A....

....Don't think me unkind

Words are hard to find

They're only cheques I've left unsigned

From the banks of chaos in my mind....

Recently:

"LIVE BLOG: Tesla Q1 2024 earnings call"

"Is Elon Musk About To Force Everyone To View Tesla As An AI Company After Earnings?" (TSLA)

"On Earnings Calls, Do Executives Mumble on Purpose?"

"Ahead Of Next Week's Tesla Earnings Report, A Reminder (TSLA)"

From Business Insider via AOL, April 24:

- A South Korean woman lost $50,000 after falling in love with a fake Elon Musk.

- The Musk impersonator befriended her on Instagram, where he told her he "contacts fans randomly."

- Fake Musk then claimed he could make the woman rich by helping her invest her money.

A South Korean woman says she lost $50,000 to a con artist who was posing as Elon Musk.

"On July 17 last year, Musk added me as a friend on Instagram. Although I have been a huge fan of Musk after reading his biography, I doubted it at first," the woman, who declined to provide her real name, told South Korean broadcaster KBS in an "In Depth 60 Minutes" interview that aired April 19, per a translation from The Korea Herald.

The woman said she began to believe that she was conversing with the real Musk after the person she was talking to sent her photos of what appeared to be Musk's ID card and images of himself at work.

"'Musk' talked about his children and about taking a helicopter to work at Tesla or Space X," she told KBS. "He also explained that he contacts fans randomly."

The fake Musk, the woman said, even shared details about a meeting that the real Musk had with South Korean President Yoon Suk Yeol in April 2023. The impersonator said Yoon told "Musk" to build Tesla's Gigafactories in Seoul and Jeju.

"'Musk' even said 'I love you, you know that?' when we made a video call," the woman said, referencing a video call with what was likely to be a deepfake of Musk....

....MORE

From Business Insider via Yahoo Finance, April 22:

- Markets are still just in the first phase of an AI-led upsurge, Goldman Sachs wrote in a recent research note.

- Nvidia is the central piece in the opening inning, but analysts still see more upside in further phases of the AI story.

- The firm says eventually, AI will broaden to benefit other sectors, such as computer services.

Artificial intelligence has already propelled markets into overdrive, and yet this equity power fuel is nowhere close to running low, Goldman Sachs said.

Instead, stocks are just in the first phase of the AI-led upsurge, which will broaden out to uplift more and more sectors, the bank said in a Tuesday post.

"If Nvidia represents the first phase of the AI trade, Phase 2 will be about other companies that are helping to build AI-related infrastructure," it said. "Phase 3 deals with companies incorporating AI into their products to boost revenue, while Phase 4 is about the AI-related productivity gains that should be possible across many businesses."

Here's a deeper rundown of Goldman's AI timeline:

First phase

Ever since ChatGPT sparked the AI race in late 2022, chipmaker Nvidia has catapulted in markets. Given that its semiconductors are the basis for this emerging software, the company has made itself a cornerstone of the technological transition, climbing as much as 590% in this period.

"Remarkably, though, those gains have been entirely driven by earnings growth: The company's price-to-earnings ratio is barely higher than it was at the start of last year," Goldman said.

Supporting the view that the first phase is not over, analysts see even more gains ahead. Recently, Evercore ISI put out a bull target of $1,540, representing 81% upside from Friday's stock price.

"We think investors underestimate the importance of the chip+hardware+software ecosystem that Nvidia has created," analysts said.

Second phase

Eventually, Goldman expects other firms to benefit from the AI buildout, though this isn't limited to just semiconductor producers and designers. Cloud providers, computer equipment makers and security software developers will all have a part to play.

That also extends to real world infrastructure, as AI will need expansive data centers to run it — a boost to everything from real estate to the utility sector.

It's a bet also made by investing legend Steve Eisman, who previously explained that the new GPUs require three times as much electricity as traditional hardware. The accelerated power demand will amplify spending on grid improvements and the companies that run it.

Third phase....

....MUCH MORE

From Bloomberg, April 23:

An unusual and iron-clad will locked one of the most important coin collections in the world away for a century.

The descendants of the Danish butter magnate Lars Emil Bruun waited exactly 100 years to claim their now $72 million inheritance. Not by choice.

At least one grandchild reportedly tried and failed to break Bruun’s will, which specified that his 20,000-piece coin collection should remain intact and stored away, then be sold at auction after a century elapsed.

Now, finally, the time has come. The trove of coins and medals will be sold over several years via the coin auction house and dealer Stack’s Bowers. The first tranche of the collection is set to hit the block this fall. “When I first heard about the collection a couple years back,” says Vicken Yegparian, the company’s vice president for numismatics, “I was flabbergasted that something like this could exist.”

Safekeeping Cultural Patrimony

Over the course of his life, Bruun (1852-1923) created a monumental collection of coins, medals and paper currency, predominantly from countries with some connection to Scandinavia.“You’ve got Denmark, Norway, Sweden and then places that used to be under Danish or Norwegian or Swedish rule,” says Yegparian, name-checking places as varied as the Danish West Indies (now the US Virgin Islands) and Tranquebar (now Tharangambadi), a onetime Danish outpost in India. Bruun even collected English coins from when the Danes ruled the country. “There’s a huge run of coins from King Canute of England,” Yegparian says.

Once Bruun had accumulated all these objects, though, he began to weigh their national significance.

Having lived through the devastation of World War I, Bruun was understandably skittish about Denmark’s cultural patrimony. As a consequence, he decided to frame his collection as a sort of backup to the Royal Danish Collection of Coins and Medals, “as a redundancy and a protection against something happening to the existing collection,” says Brian Kendrella, president of Stack’s Bowers. Bruun decided that after 100 years, if the national collection had remained intact, it would be safe to sell his own collection at public auction. Proceeds were willed to his direct heirs.

And so for the past 100 years his collection has sat, mostly undisturbed, available to scholars when they’ve asked and locked away to everyone else, Kendrella says.

Living With a Gold Mine

Through the auction house, his heirs declined to comment. The Danish media have been interested in this story for years, however, and from time to time, Bruun’s descendants have commented publicly on the looming inheritance, with one noting that his father was a taxi driver and that he might “buy a new golf set” if and when the collection was sold.

The irony, Yegparian says, is that by stashing away his collection for 100 years, Bruun managed to successfully safeguard his family’s intergenerational wealth....

....MUCH MORE

These long time-horizons really can be tricky and Mr. Brunn is to be commended for his understanding of possible issues. When the Nazis invaded Denmark in April 1940 the value, if not the valuation, of having these tiny treasures dispersed and separate from the Royal collection would be made obvious.

For a slightly different long term asset see: